Summary

- 77% of Americans will have paid more taxes in 2013.

- Higher tax rates are coinciding with a bottoming and eventual reversal of the interest rate cycle…As investors are embracing tactical asset allocation strategies.

- Why Tactical – Drawdowns.

- The Cost of Managing Drawdowns.

- The key to the current environment is to know when the benefits of trading outweigh the costs of taxes.

77% of Americans will have paid more taxes in 2013 as a result of The American Taxpayer Relief Act of 2012, according to the Tax Policy Center. The increases in top federal income tax rates are fueling demand for solutions that can help investors keep more of what they earned (Chart 1).

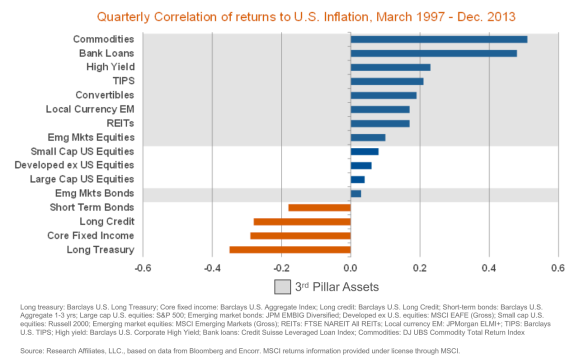

Unfortunately for many investors in the upper tax brackets, higher tax rates are coinciding with the bottoming and eventual reversal of the interest rate cycle. In anticipation of rising rates investors are embracing tactical asset allocation to help them capture investment returns. Here lies the conundrum, as some tactical strategies can create tax inefficiency due to short-term capital gains. Therefore, the key to the current environment is to know when the benefits of trading outweigh the costs of taxes.

(Chart 1)

(click to enlarge)

Newfound Research provides the tactical overlay to the Risk Managed Core Diversifier (RMCD) strategy, and is considered a leader in the category of managed volatility strategies. Newfound has published several pieces on the topic of being tactical about trading and taxes. Here is an excerpt from a recent white paper:

“Tactical strategies rely on a variety of methods for selecting assets that should be bought or sold to meet investment objectives. Financial advisors also make similar decisions in client accounts. Considering these decisions in isolation neglects the very real impact of taxes on the overall outcome in after-tax accounts. Each decision to trade must be examined in the context of taxes. Thus, the central question is: When do the benefits from trading outweigh the costs of taxes?”

(Read the full white paper here; Read the summary here)

HIGHER TAXES ARE HERE TO STAY

Unfortunately, the current tax environment is likely to remain elevated for a while given the record amount of national debt, and the debt to GDP (gross domestic product) of the United States. As Washington battles to address the long-term health of the economy higher taxes are certainly an important component to fixing the problem.

(Chart 2)

(click to enlarge)

RULE OF 72, 96 , & 120

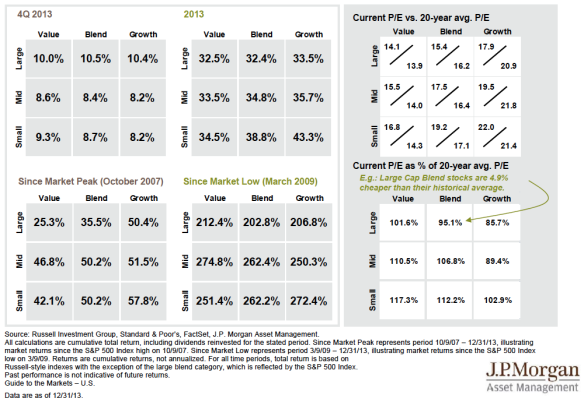

Higher taxes rates affect many things, including how investors should plan to accumulate, maintain, and distribute their wealth. It also affects the rules of math. The Rule of 72 is well known as a simplified way to determine how long an investment will take to double, given a fixed annual rate of interest and the powers of compounding.

Two lesser know rules of math are the Rule of 96, and the Rule of 120. These rules take into account the 25% and 39.6% annual tax rates for taxable accounts (chart 3). Essentially, in taxable accounts higher tax bracket investors require more time to double their money.

(Chart 3)

WHY TACTICAL – DRAWDOWNS

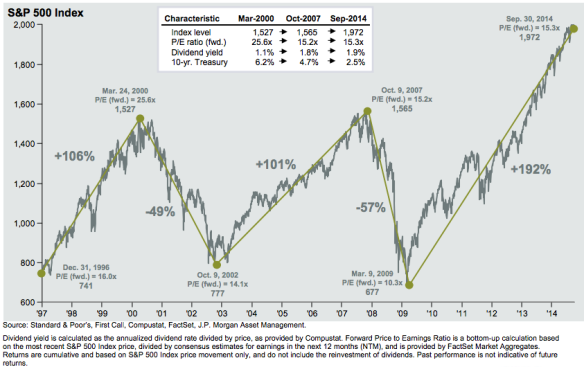

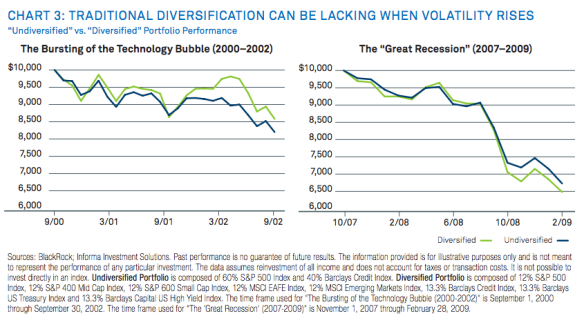

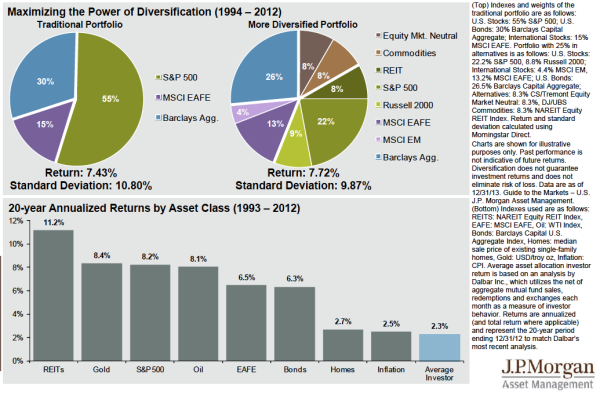

Adding bonds to equity portfolios has long stood as a means for reducing equity volatility, and for limiting losses in a diversified portfolio. However, since the bursting of the tech bubble in 2000, traditional diversification can be lacking when volatility rises, leaving portfolios vulnerable to drawdowns (peak-to-trough loss sustained by an investment over a given time frame).

(Chart 4)

Traditional diversification can be considered a non-guaranteed insurance policy. However, given the effectiveness since 2000 at limiting drawdowns, the premium is getting more expensive. (For more information see, Newfound Research’s white paper titled, “The Case For Tactical Asset Allocation”).

Below is an excerpt:

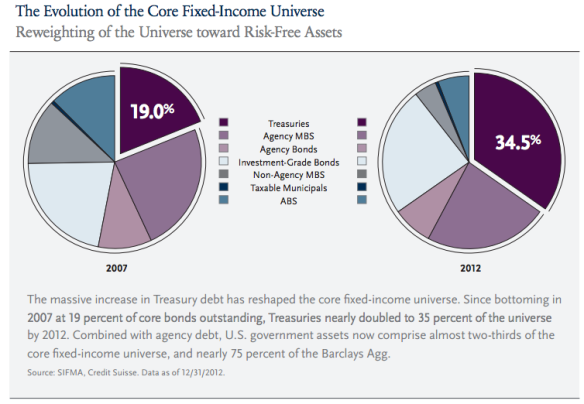

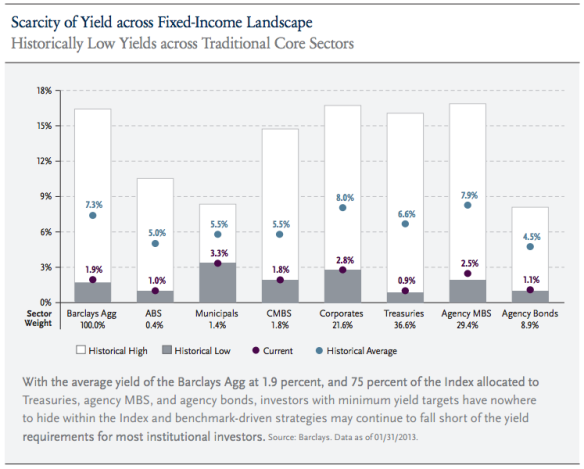

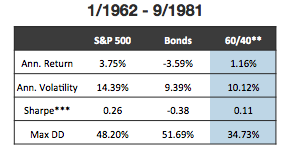

One of the unique realities of the last 20 years has been the bull market in U.S. Treasuries due to declining interest rates. This trend has created an environment whereby our risk mitigator was also a tremendous return generator. This made a 60/40 portfolio an incredibly attractive investment profile (Chart 5).

However, this reality was not always the case. Older investors will remember a very different interest rate environment whereby the use of the risk mitigator within the portfolio came with a hefty premium. From 1963 to late 1981, a constant maturity index of 10-year U.S. Treasuries had an annualized LOSS of 3.15%: diversification was certainly not free (Chart 6).

(Chart 5)

(Chart 6)

THE COST OF MANAGING DRAWDOWNS

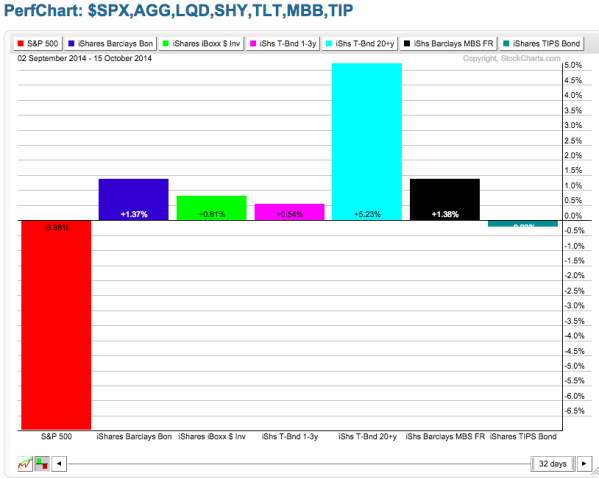

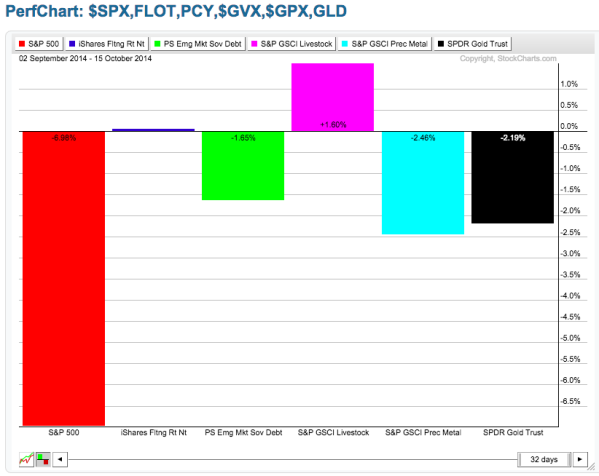

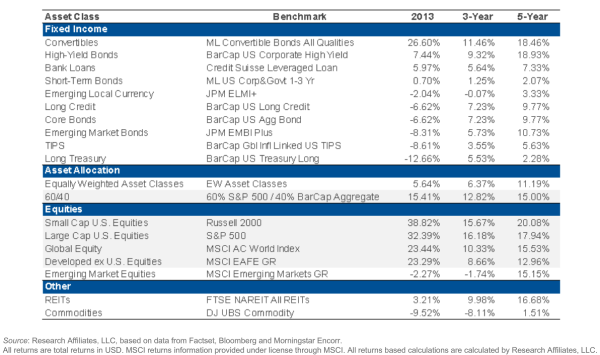

Investors have been managing drawdowns for decades through different portfolio management techniques. Each technique has its own “implicit performance cost”, for the loss protection. If the loss protection was larger than the implicit performance cost then the tradeoff was worth it. Going forward however, a static allocation to bonds is not likely to be the return generator that it was for the last 20 years, solely because of where we stand today within the interest rate cycle (near zero).

As a result, investors should consider other techniques to manage drawdowns. At IronGate we prefer a momentum model, as it can retain the return structure in normal market conditions, yet protect capital without giving up return potential in bull markets (For more info, see Newfound’s blog post on Drawdowns).

(Chart 7)

(Chart 8)

THE VALUE OF WAITING TO TRADE WHEN CONSIDERING TAXES

Despite the exponential growth of tactical trading strategies since the financial crisis, not enough attention has been given to possible solutions of reducing taxes when allocating to tactical trading strategies. This is particularly important for higher income investors with most of their money in taxable accounts.

In normal markets with low volatility, reducing portfolio turnover is a simple and effective way to increase tax efficiency. It can also reduce whipsaws and therefore, reduce performance drag as the markets slowly grind higher.

In fact, this is our primary method of reducing the tax impact on a portfolio. Newfound’s tactical overlay on the Risk Managed Core Diversifier strategy aims to strike a balance between capitalizing on opportunities for outperformance and turnover/trading frequency. This also reduces transaction costs and can avoid triggering wash sales.

However, in fast markets, as correlations increase, and the benefits of diversification begin to disappear, the risk of sizable drawdowns can increase. In these environments factoring tax impacts into the trading decisions adds additional value. Looking at the cost/benefit of trading now, versus waiting until more favorable tax treatment can significantly increase returns.

“So when do we actually execute our trades given by our tactical strategy? The answer is a resounding: it depends. We must be aware of our different tax lots and sell them efficiently; we must be cognizant of the wash sale rules..And perhaps most importantly, we must understand and be able to quantify the value added by the model’s decision to act immediately” (Nathan Faber – Newfound’s recent blog post “The Value of Waiting To Trade When Considering Taxes”).

BALANCING THE BENEFITS OF DIVERSIFICATION WITH THE NEED TO BE TACTICAL

In summary, higher tax rates are likely to remain elevated for some time as the leadership in Washington works to improve the health of the economy and lowers the debt to GDP of the United States. At the same time, near zero interest rates limit the effectiveness of a traditional allocation to bonds which has served investors well as both a risk mitigator and return enhancer to equity portfolios.

As a result, the current tax and valuations environment is fueling investor demand for outcome oriented solutions that can tax efficiently and capture returns in normal markets, yet adapt to fast markets by looking at the cost/benefit of trading now to protect against drawdowns.

The above information was taken from the Managed Volatility Newsletter (6/12/2014)

Sign up for the Managed Volatility eNewsletter