The recent comments by Fed Chair Janet Yellen of keeping interest rates artificially low for another 2 years should have savers yellen’. Today’s near zero interest rates are causing savers to take uncomfortable credit risk or duration risk to earn a reasonable yield on their “safe money”.

The Core Conundrum

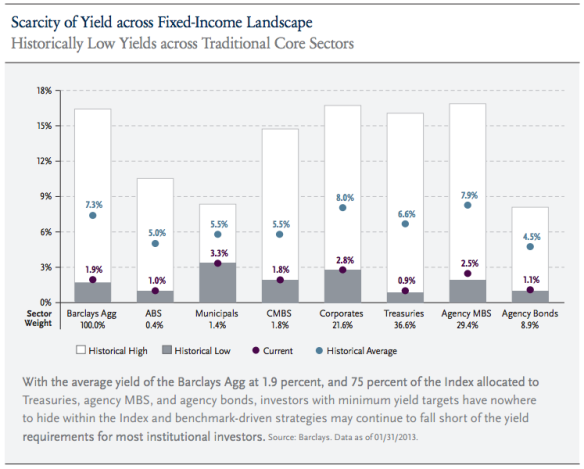

The problem of low yields has coincided with a dramatic change in the composition of the index that is most often used to measure bond performance. Institutional and individual fixed income investors are dealing with the market realities of yields as the flagship bond benchmark (Barclay Aggregate Bond Index) languishing around 1.9%. The artificially low yields held down by the Fed has created a chasm between investors’ return targets and the realities of a benchmark with negative real yields. Bridging this gap, without assuming undue credit or duration risk, requires a shift away from the traditional view of core fixed-income management in favor of a more diversified, multi-sector approach.

Unfortunately, in an environment where the benchmark index has become approximately 75% allocated to low-yielding government and agency securities, maintaining a low tracking error and pursuing total return targets have seemingly become contradictory objectives.

Barclay Agg Index – Not What It Used To Be

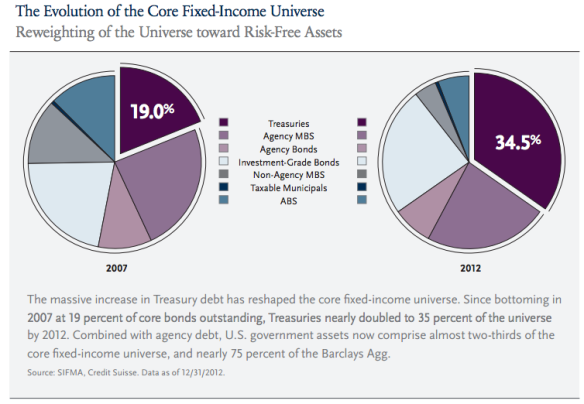

Over the past five years, the composition of the Barclays Agg has changed by the massive volume of Treasuries issued in response to the US financial crisis. According to the Congressional Budget Office this trend should continue to explode. “The US Treasury debt balance totaled $4.5 trillion in 2007. By the end of 2012, it had skyrocketed to over $11 trillion. Yet, it is projected to go even higher – hitting $18.9 trillion by 2022.”

As Treasuries climbed from 19% of the core fixed-income universe to 35% over the last five years, the market-capitalization weighted Agg has followed suit. Treasuries currently comprise 37% of the Agg, and combined with agency debt, total US government-related debt comprises nearly 75% of the index with a weighted-average yield of 1.6%, as of January 31, 2013.

Anchored to a benchmark heavily allocated to sectors yielding negative real rates of return has forced investors to reassess the traditional, benchmark-driven approach to core fixed-income management.

Active Asset Allocation Matters in Today’s Environment

In today’s low yield environment, investors should embrace active management across a global multi-sector fixed income portfolio to generate higher yields AND to control drawdowns. As the Fed takes it’s foot off the gas of monetary easing, volatility in equities, bonds and interest rates should continue to increase. Just how fast and how far interest rates move is a key question but extremely difficult to predict.

Given the level of Central Bank intervention across the globe, the US Fed is likely to intervene to help limit market disruptions. Unfortunately, the blunt instruments of monetary easing and fiscal policy have not proven responsive enough to prevent sharp moves across the interest rate curve.

Defending Portfolios Against Drawdowns

Traditionally active asset allocation has limited the amount of cash a strategy could raise to minimize tracking error from its benchmark. However, investors have begun to realize that a 60/40 core portfolio may not be enough to limit the amount a portfolio could lose from peek to trough (drawdown). Especially with the growing amount of US Treasury and Agency exposure to the popular Barclays Agg Index.

Options, futures, long/short, risk parity, and other traditional alternative investments have long been used to reduce correlations of core portfolios. But the challenge of adding these alternative strategies can come with the added cost of losing upside return capture when the return enhancing asset classes are performing.

As a result investors are plowing assets into strategies that are flexible enough to go to 100% cash, as they are looking for cost effective ways to defend their portfolio’s against drawdowns…while minimizing the added cost of limited upside capture. Being tactical about tactical can allow investors to participate up and protect down.

Return Enhancers

Keeping strategic (long-term) allocations to the satellite asset classes may not be the most effective way to enhance the risk adjusted returns of a portfolio. For example, adding a strategic allocation to Emerging Market equities or even EM bonds over the last few years would have had been difficult for many investors. However, tactical exposure to these return enhancing asset classes could have avoided much of the pain, and kept the portfolio on track to meet investor objectives.

Some satellite asset classes to consider as return enhancers to a portfolio:

- Emerging market equity

- Emerging market bonds (hedged, unhedged)

- MLPs

- Real estate

- High yield bonds

- Levered loans

- Corporate floating rate notes

- Commodities

- Energy

- Agriculture

- Base metals

- Gold

By incorporating a single risk-managed solution around the return enhancing asset classes of a core 60/40 portfolio, investors maybe a big step closer in solving the core conundrum.

Other Article / Videos related to this topic:

- Bogle: We need to fix the bond index (Morningstar)

- Yellen’s mind-the-gap goals rule says rates stay low (Bloomberg)

- Retirees, brace yourselves for rising interest rates (CNBC.com)

- The shift toward value continues (BlackRock – Russ Koesterich)

- Diversification is difficult when correlations are rising (BlackRock)