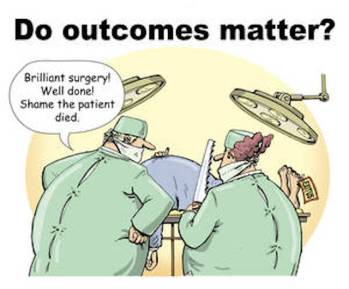

In the article below, Sean Clark provides a good overview of how advisors can use Smart Beta strategies to achieve certain outcomes for their clients, hence the term “outcome-oriented solutions”. However, as we move further away from the 2007-2009 financial crisis, some advisors and their clients maybe forgetting about another outcome that can have a much bigger impact on performance, and subsequent withdrawal streams…DRAWDOWNS.

Most Smart Beta strategies are not tail-hedged. Meaning they can still have significant losses during bear markets, and crisis periods. They may offer slightly lower drawdowns given the factor tilts, but they don’t provide an added layer of risk management to defend against drawdowns. Fortunately, there are tactical ETF Portfolio Strategists that provide drawdown overlay strategies to Smart Beta ETFs to deliver more robust “outcomes” that many advisors and their clients seek.

The challenge becomes managing the hidden costs of the drawdown overlay strategy, the whipsaw events, and their tax impact. All tactical strategies are prone to whipsaw events, when the investment strategy makes a wrong trade in an effort to limit drawdowns. The “opportunity cost” of that whipsaw can drag down performance, and add to the cost of the active strategy. Since the U.S. stock market began its recovery in March of 2009, there have been a a number significant whipsaw events worth noting: May-June 2010, when the S&P 500 lost 13.7%, only to quickly rebound and continue its upward trend; May-Sept 2011, when the S&P 500 lost 19.25%, but quickly reversed course; May 2012, when the S&P 500 lost 8.9%, and quickly rebounded; and Sept-Oct 2014, when the S&P 500 lost 7.4% to once again quickly recover. When evaluating tactical ETF Portfolio Strategies, advisors should not just look at the risk / return characteristics, as they also need to dig deeper into the number of false positives that strategy had, and the risk controls the strategy uses to limit the impact of the whipsaw events.

Taxes are another “hidden cost” of owning tactical ETF Portfolio Strategies. To help reduce the costs of implementing these more active strategies, Separately Managed Accounts (SMAs) can be more tax efficient than mutual funds. As we approach year end, some tactical strategies can have large distributions as a result of the whipsaw events, which can be problematic for investors that only recently purchased the mutual fund, received the distribution, but did not enjoy the benefit of the realized capital gains. When implementing SMAs, advisors have better control and more choices. Some SMA/UMA platforms offer a tax overlay strategy to help reduce clients’ taxable gains and can be another value added deliverable of the advisor.

In conclusion, advisors and their clients need a deeper understanding of how to create better outcomes using Smart Beta strategies. If they choose to implement tactical strategies to defend against drawdowns, they need to also understand how to manage the hidden costs. For those that can do this effectively, the outcomes can be dramatically different especially after the next bear market. At IronGate Investment Management, we hope this serves as a friendly reminder that the current 5 1/2 year bull market has benefited from massive government stimulus, and near zero interest rates that have inflated asset prices. With the end of QE, advisors and their clients maybe well served to implement both Smart Beta and tactical ETF Portfolio Strategies that can manage the whipsaw costs, drawdowns, and tax impact now that the Federal Reserve has begun the process of making the U.S. economy stand on its own two feet.

‘Smart Beta’: Bridging Active Vs. Passive | ETF.com etf.com

In a world divided into active and passive camps, ‘smart beta’ is emerging as an interesting middle ground.