The proliferation of liquid alternative strategies is causing many advisors to take a ridiculous amount of time away from serving their clients. It has been said, you’ll spend 90% of your time looking at alternatives, and it will make up just 10% of your portfolio.

According to Morningstar the number of mutual funds in the alternative category has exploded from 116 in 2004 to 429 funds as of February 2014; with $22b exploding to $144b over the same time frame. In 2013 alone net inflows into the category were an astonishing $40b.

To help wade through the maze of liquid alternatives, advisors would be better served to examine WHY they are incorporating alternatives in the first place. Is it as a risk-mitigator? Is it as a return enhancer? Or, is it both? With a foundational understanding, advisors can be prepared to incorporate liquid alternatives while maintaining scalability so they can continue to serve their clients.

RISK MITIGATOR?

With near zero interest rates and the prospects of higher interest rates on the horizon, many advisors are preemptively turning to liquid alternatives to anchor the portfolio from equity volatility, and to provide some alternative sources of yield to a portfolio. The challenge remains, since so many liquid alt strategies are single asset class or strategy specific, how do you know which will be the “hot dot” and the right one to include in your client portfolios. The answer is you don’t…much like predicting the future return profiles of traditional asset classes its almost impossible. So diversification can be used to smooth client returns, and to keep clients focused on reaching their goals.

Do multi-alternative strategies provide an advisor diversification benefits? Maybe, it’s scalable, and defensible in client meetings. But how much can an advisor really allocate to a liquid alternative portfolio, when the strategy has significantly higher costs, will likely never outperform in up markets, and will most always be a performance drag? Wouldn’t lower cost, flexible income funds, with allocations to floaters, TIPS, and convertibles be enough in a rising rate environment?

RETURN ENHANCER?

Many clients and advisors turn to liquid alts as return enhancers. Investors have been conditioned to invest like an institution, as many sales professionals point to the long-term out-performance of the ivy league endowments. Unfortunately, most advisors don’t have the ivy league resources or the 100 year time horizons of those institutions. This can leave many advisors to setting high expectations and under-delivering returns.

So many advisors try to pick the hot liquid alternative asset class, or hot manager that happens to be in the sweet spot of the market and currently outperforming albeit with the ability to hedge a portfolio when the market turns.

Here lies the time-trap. Picking the right liquid alt strategy even some of the time, requires an extraordinary amount of time, diligence, and discipline that most advisors don’t possess.

BOTH RISK MITIGATOR & RETURN ENHANCER?

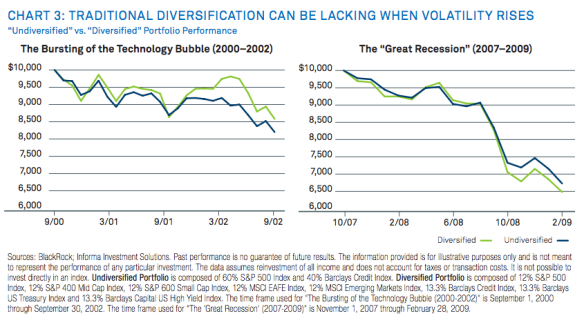

If the 30 year bond bull market wasn’t over, would there be so many assets flowing into liquid alternative strategies? If investors hadn’t experience the “Great Recession” when even a diversified portfolio lost more than 30%, would liquid alternatives be where they are today?

Clearly, the demand for liquid alternatives is real and for good reason. But advisors shouldn’t have to make the trade-off of risk mitigator vs. return enhancer. If advisors step back and re-examine WHY they are allocating to liquid alts, they would be in a better position to sort through the noise.

The two common investment problems, that many advisors are trying to solve with liquid alts are:

1) Diversification can disappear when needed the most. In 2008-09, fixed income was not enough to limit drawdowns and many traditional return-enhancers such as emerging market equities, REITs, and commodities all lost more than 60%, exacerbating large core equity market losses during the same period.

2) Non-core exposures (including liquid alts) can significantly underperform core exposures in the short to medium term (ex., 2006, 2008, 2012, & 2013).

For these reasons and more, some advisors are turning to “outcome-oriented solutions” to limit portfolio drawdowns. These solutions seek to deliver return-enhancement AND risk mitigation while bring scale into advisor practices. These real world solutions, can put the clients’ interest first, and allow advisors to focus their time and attention on serving the client, not navigating the maze of liquid alternatives…Unfortunately, too many of today’s liquid alternative strategies limit their “outcome-oriented solution” to just being a bond fund alternative.

The perfect storm: Why alts make sense (Investment News) The modern financial advice industry may have never experienced a time when the case for allocating assets into alternative strategies made perfect sense. Until now. With the equity market at an all-time high, bond yields hovering near record lows, volatility spiking and global geopolitical risks rising, diversifying into products and strategies designed to hedge risk can mean that clients can sleep soundly at night…

The perfect storm: Why alts make sense (Investment News) The modern financial advice industry may have never experienced a time when the case for allocating assets into alternative strategies made perfect sense. Until now. With the equity market at an all-time high, bond yields hovering near record lows, volatility spiking and global geopolitical risks rising, diversifying into products and strategies designed to hedge risk can mean that clients can sleep soundly at night…