Click here for Intelligent Diversification – Periodic Table

Smart Beta is receiving a lot of media attention and asset flow these days. But what about “Intelligent Diversification”?

If smart beta strategies are alternatives to market-cap weightings, then what do you call strategies that seek to maintain diversification benefits when correlations are rising…”Intelligent Diversification”?

As the BlackRock article below points out, diversification is difficult when correlations are rising. This is especially true for non-core exposures as advisors are sold them under the notion that they have a low correlation to core exposures.

The problem is that every asset class has changing correlations, including alternatives. In fast markets (or crisis periods) correlations often move towards one, and diversification can disappear. At IronGate we believe diversification is a good first line of defense, but it has its limits, and balance the need to be tactical by aggressively raising cash.

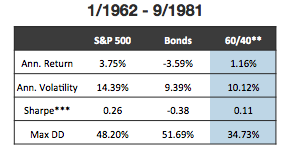

Now that the 30 year bond bull market has been officially pronounced dead, advisors need to be more vigilant about managing portfolio risk. Gone are the days when an advisor can simply add core fixed income to a US equity portfolio and maintain diversification (as the BlackRock article clearly points out).

As advisors add more complex alternative strategies to their clients’ portfolios, it is even more important to measure the portfolios’ effectiveness in maintaining diversification. For many advisors, it would be more effective to have a single solution to serve as a core-diversifier so they can focus on serving their clients and growing their business.

To learn more, click: http://www.ManagedVolatility.com