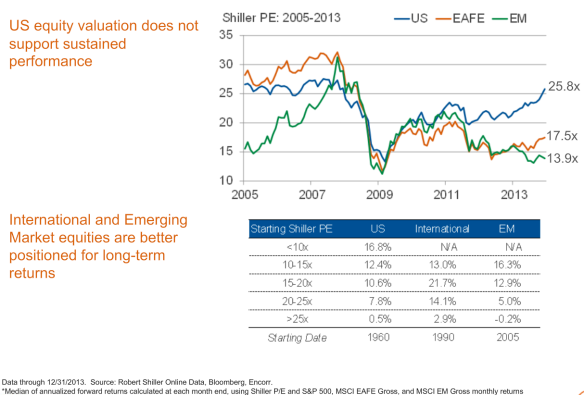

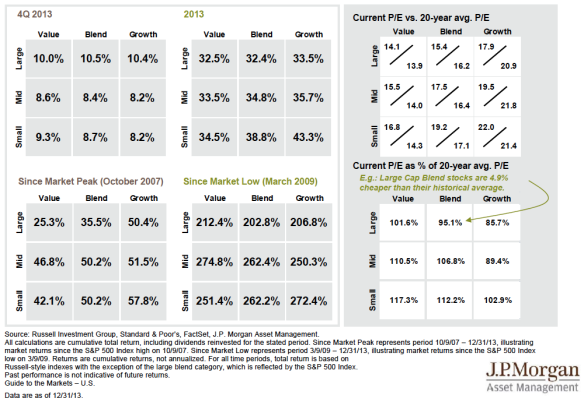

Since the March 2009 lows US stocks have rallied over 200%, and valuations are back up near their 20 year P/E highs…making them fairly valued at best, and certainly not cheap (chart 1).

Chart 1

When evaluating securities or broader markets it is important to look at both relative value and absolute value. On its own, relative value can be interesting but taken together with absolute value it can be compelling, allowing investors to gain increased confidence when choosing where to allocate their dollars. Once you have identified relative AND absolute value, its becomes a matter of extracting that value…otherwise know as, the investment strategy. Traditionally, professional value investors buy early and wait for the market to realize that value, often having a catalyst. Unfortunately, this contrarian style does have it’s drawbacks…periods of significant underperformance. That is why we prefer a Managed Volatility approach that incorporates momentum.

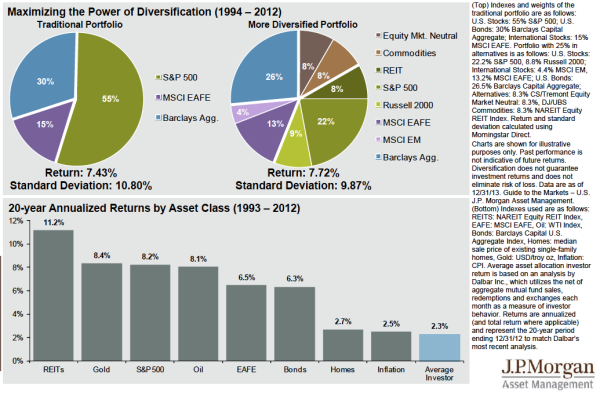

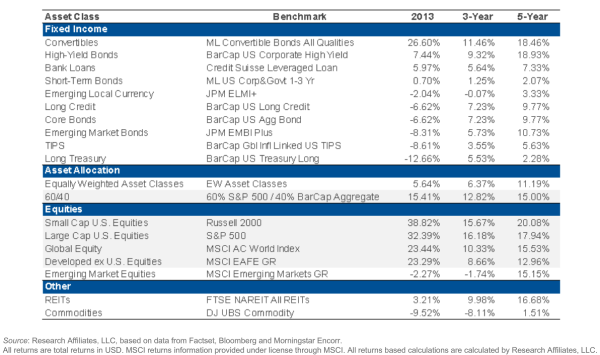

In today’s “what have you done for me lately” society a contrarian investment strategy can be very difficult for average investors to implement, which helps explain why most investors have significantly underperformed the market averages (chart 2). To make it even more challenging for investors, a year like 2013 occurs when there is a bull market in equities, and a bear market in most everything else (chart 3).

DEVELOPED & EMERGING MARKETS – RELATIVE AND ABSOLUTE VALUE

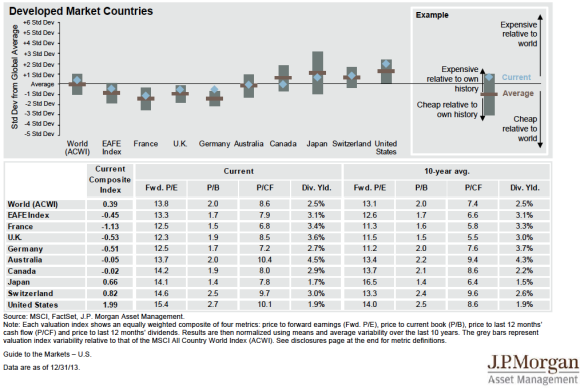

Examining the relative valuation levels of developed market countries provides a deeper understanding of value, and shows US equities are expensive relative to their own history, and expensive relative to other developed countries (chart 4). Disciplined investing tells us that when you get outsized returns in a single year like 2013, it is important to ratchet down your return expectations for that asset class for the next several years. Investors should thank Mr. Market for providing several years of returns in a single year, then have an investment strategy that can rebalance their portfolios toward the areas of the market that are cheap…as it is being realized by the market (momentum).

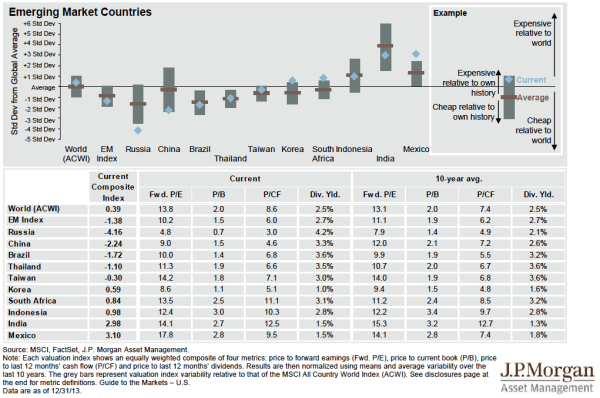

Charts 5, examines the relative value in emerging markets, but it begins to tell a different story. The recent selloff in emerging markets has brought several EM country valuations below their own historical average, but it doesn’t necessarily mean they are done falling. Using a forward looking P/E does have its limitations due to earnings volatility, and is why Noble Prizing winning economist Dr. Robert Shiller created the Shiller P/E, which is adjusted using trailing 10-year average, inflation adjusted earnings (chart 6).

The Shiller P/E provides an opportunity to identify absolute value. Chart 6, compares the absolute value of US, International, and Emerging Market equities. Using it allows investors to conclude that US equity valuation does not support sustained performance; and International and Emerging Market equities are better positioned for long-term returns.

THERE’S ABSOLUTE VALUE IN INFLATION HEDGES

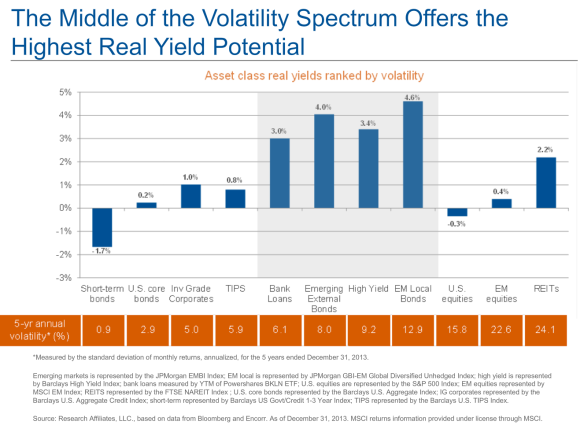

The current low inflationary environment has created significant value in assets that traditionally do well in rising rate environments (chart 7). Asset classes such as Bank Loans, Emerging Market Bonds, and High Yield Bonds offer the best real yield opportunities.

The trouble for many advisors and their clients, is intelligently allocating to these asset classes before the market moves that direction, and thus the challenge of behavioral finance. As a liquid alternative, investors should consider momentum based investment strategies, that include these non-core holdings within their investment universe, but have the flexibility to pivot to core exposures to close the performance gap, such as 2013.

FAIL TO PREPARE, PREPARE TO FAIL

May 22, 2013 could have marked the lows in long term interest rates and the end of the 30 year bull market in bonds. We are entering a new era where interest rates are inevitably heading higher over the long term. After a very challenging winter where extreme weather dampened economic activity, pent-up consumer demand will likely spur a second quarter rebound in economic growth. This may push credit spreads even tighter, and as the economy gathers steam over the coarse of the next year or two.

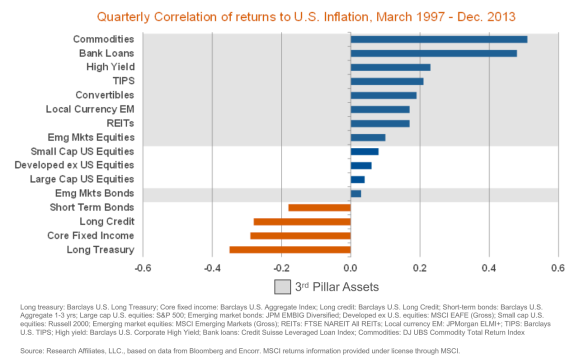

A stronger economy and rising inflation should cause last years underperforming asset classes to do well. Chart 8, breaks down the non-core assets and their correlation with US inflation. Investors need to decide how to include them in their portfolios. Given the structural risks that still face the global economy, we prefer a Managed Volatility approach that uses AVAILABLE diversification as a first line of defense to a portfolio. Recognizes that the benefits of diversification can disappear when needed the most, and uses being tactical as a second line of defense to limit drawdowns.