(Read Part 1 – The Need For Managed Volatility – Systemic Risks)

MARKET RISKS ARE CONSTANTLY CHANGING

As new information flows into the markets buyers and sellers digest the news, and adjust asset prices accordingly. In “normal markets” the information flow is digested and prices adjust in an orderly manner and within normal volatility ranges. Price trends can continue as momentum persists. However, information can also flow much more quickly into the markets during “fast markets”, and asset price changes and volatility ranges expand…both up and down.

“The premier [market] anomaly is momentum.” – Eugene Fama & Kennet French (2007)

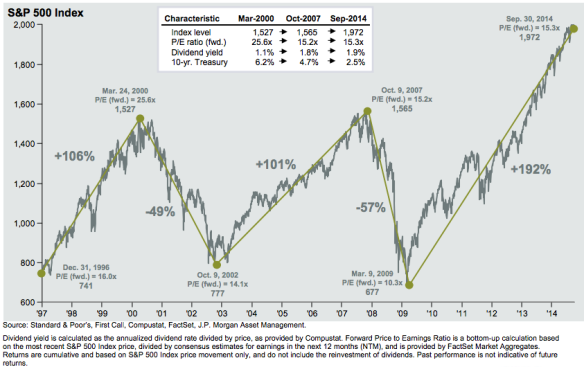

Some of the best opportunities are created in fast markets across asset classes. As the amount and frequency of new information flowing into the market increases price uncertainty can can cause crisis periods when correlations across assets classes crash towards one, and the benefits of diversification disappear when needed the most. For example, tremendous opportunities were created after the three year bear market in U.S. equities 2000-2002, when most risk assets took off for an extraordinary run, gaining more than 100% from 2003-2007. Opportunities were once again created in March of 2009, after U.S. equities sold off more than 50%, and rebounded nearly 200% as a result of the extra-ordinary actions take by the U.S. Federal Reserve.

Unfortunately, for investors still using diversification alone as their only means to defend against losses (drawdowns), it was difficult to take advantage of the financial crisis since they did not have much cash on hand to buy at the lower prices. For those investors that stayed invested, and were lucky enough to recover after a tumultuous ride, they could not take advantage of the new opportunities because they were trying to recover the losses caused by the volatility.

For tactical investors the experience was much different, as opportunities were everywhere and they had plenty of cash to deploy when prices corrected. As upward price momentum began to reemerge, new trends were established, losses were erased more quickly, and new gains were captured.

BEWARE OF THE ADDED COSTS OF TACTICAL

The tactical scenario above sounds simple enough but it can be very difficult to implement without a rules-based process that can adapt to the current environment’s information flow. Compared to static strategies, all tactical strategies have an added cost known as whipsaws (the consistent mis-timing in the purchase and sale of securities).

“When no trend exists, momentum strategies can suffer from whipsaws (the consistent mis-timing in the purchase and sale of securities) and excessive costs from high turnover. In the worst case scenario, a portfolio might suffer a “death from a thousand paper cuts” before a trend re-emerges. It is critical, therefore, to employ a process that is as robust as possible to these risks.” (Newfound Research White Paper: “Newfound’s Dynamic Momentum”; www.ThinkNewfound.com).

(For more info, also read: “Managing Whipsaw Risks by Measuring Potential Changes to Tracking Error”, by Newfound Research).

To offset the added cost of whipsaws some strategies add the ability to use leverage to increase the upside capture during the previous uptrend. This can be very effective at times, but investors have to understand leverage in itself is not free, and when a whipsaw occurs with leverage applied, there can be a triple-whammy effect: 1) the initial loss during the selloff, 2) exacerbated losses due to the leverage, 3) and the opportunity cost of the rebound.

COMBINING DIVERSIFICATION & TACTICAL

History never repeats itself, but it often rhymes. Investors may want to consider combining diversification and tactical to enjoy the benefits of both risk management techniques. Diversification can be one of the cheapest ways to limit portfolio drawdowns. However, since the benefits of diversification can disappear when needed the most, adding tactical as a second line of defense, to defend against large drawdowns maybe a more prudent strategy than relying on just one technique.

Given the risks of today’s global economy, and the simultaneous balancing act of central banks to deleverage their economies through a devaluation of their currencies, while at the same time propping up asset prices through quantitative easing, investors may be well served to add rules-based strategies that can limit the whipsaw costs of tactical to their diversified portfolios…Opportunity is Everywhere – When You Take Control.