Since early September 2014 volatility has increased significantly in global equities, and today is no exception, as the major US equity averages have followed small and mid cap equities into negative territory for the year.

But is this just noise, or an important trend reversal? Is it a buy the dip opportunity, or a market top after a 5 year bull market?

The honest answer is, only time will tell. Listening to both sides of the argument is always interesting, and pays the bills for the financial media, but making investment decisions based on the stronger argument does not mean you will be correct.

So how can you sort the noise from the trend to improve your short and long-term investment results? At IronGate we use Newfound Research’s systematic, rule-based process that reacts to the information flow into the market and balances the benefits of diversification with the need to be tactical.

- When the information flow into the markets is slow and the volatility is just noise, the benefits of diversification are usually enough to defend against significant drawdowns.

- However, when the information flow into the markets accelerates too fast, trends are usually broken, the benefits of diversification disappear, and a second line of defense (tactical) is necessary to defend against drawdowns.

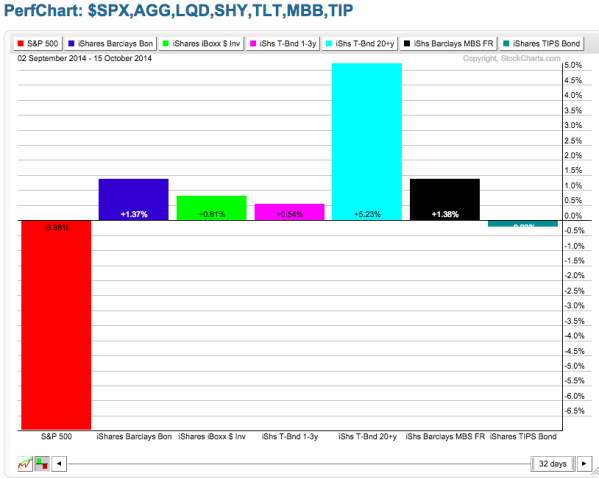

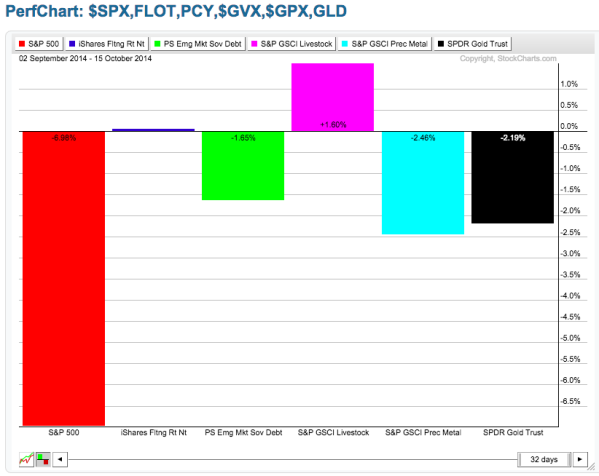

The two charts above reveal that the benefits of diversification are still available across multi fixed income, and even commodities. So at this point in time, the global equity market selloff can be considered noise, but only time will tell if a larger trend reversal has occurred.

Since investors measure risk in terms of losses, and not standard deviation, our Risk Managed Core Diversifier strategy can be more in-line with investors’ needs, and can help investors sort through the noise of the markets.

IronGate partnered with Newfound to build the Risk Managed Core Diversifier Index around the other asset classes (satellite assets) that have historically enhanced the returns of core portfolios, but with systematic risk controls to limit drawdowns. As a result, the ETF Portfolio strategy can be used as a single solution for clients’ satellite holdings, and can even be considered a core holding.

To learn more visit: www.ManagedVolatility.com